Having built the largest private port in Ukraine with his partners, Andrey Stavnitser provided a honorable tribute to his father’s memory. The new life goal is innovations.

In Spring 2014, shortly after the annexation of the Crimea, a secret plan was developed at the office of Ukrainian port operator TIS. In case of the worst scenario, i.e. if Odessa had been taken by Russian troops, the shareholders agreed to turn their infrastructural assets into a heap of metal scrap. After that meeting, General Director and co-owner of TIS group Andrey Stavnitser wrote on Facebook that Odessa was Ukraine, thus trying to win over those who were doubtful, as well as those inhabitants of Odessa who had pro-Ukrainian views.

“It was really spooky. Everyone quietened down, many had no clear stance on the matter”, - remembers Stavnitser, 38. – “What had happened in the Crimea showed us that all it could take to take over Odessa were just a 100 well-trained people taking advantage of the surprise effect”. A few days later, on the initiative of Stavnitser, a Ukrainian flag appeared in the hands of a five-meter transformer robot standing at the entrance of TIS. Stavnitser and his partners had a lot at stake. By that time, there were five TIS terminals on the shores of Maliy Adjalykskiy coastal salt lake, 27 km eastwards from Odessa, the turnover being almost 26 mil tons of grain, fertilizers, coal, iron ore and container cargos – by times more than any other stevedoring Ukrainian operator owned.

At the same time, Stavnitser was carrying out negotiations about launching his individual megaproject. In joint venture with with American Cargill, EBRD and IFC he had been planning to construct a $150 million grain terminal in the aquatic zone of the Yuzhniy port. War is not the best fellow traveler for foreign investments, however Stavnitser decided to complete the project by all means. Thereweretworeasonsforthat.

Firstly, a family reason. The idea of building a grain terminal in cooperation with global partners originally belonged to Andrey’s father Alexey, who had been the ideamonger of TIS.He had worked on the project until he passed away in 2011, after 4 years of struggling with cancer. He wasn’t able to accomplish his dream.

The second reason was personal. A successful project with a global corporation had to become a new bench mark in the businessman’s career, it would forever put to rest the matter of the heir matching up with his father’s success.

Forbes interviewed Stavnitser junior in the beginning of February, three weeks before the 10th anniversary of Alexey Stavnitser’s passing away. The businessmen gave the interview at his personal house in RSA, where he has been spending winter holidays together with his family for the last 12 years.

He sat in front of the monitor with a neatly trimmed beard, wearing a light-colored baggy style T-shirt. Fresh green tea on the table. “Nastya said I have to look good and to be slightly drunk, so I shaved and knocked down a wee, there was just a tie missing”, - jokes Stavnitser running his palm over his clean-shaven head. “There’s beautiful nature here, wonderful climate and great people,” – he explains the choice of their winter shelter. – “Perfect place to retire”.Most of his work time the businessman lately spends in Kiev.

Stavnitser does not look like a person who is going to put himself upon the shelf.Whenever the conversation drifts to business, he all at once becomes serious.In the Fall of 2020 he announced to his TIS partners that he was leaving the position of General Director, which he had had for 13 years. The company is being structured, terms of reference and competence of the new corporate center are being specified, the CEO is independent of the shareholders.An important part of the process is developing a relationships algorithm between the management and the co-owners. Stavnitser is hoping to complete all the formalities by summer 2021.

“The Supervisory Board will act as the management structure in the new system”, - explains Stavnitser. – “At the same time, we shall create a board of contracted directors. These bodies are going to interact like the Upper and Lower Houses”.

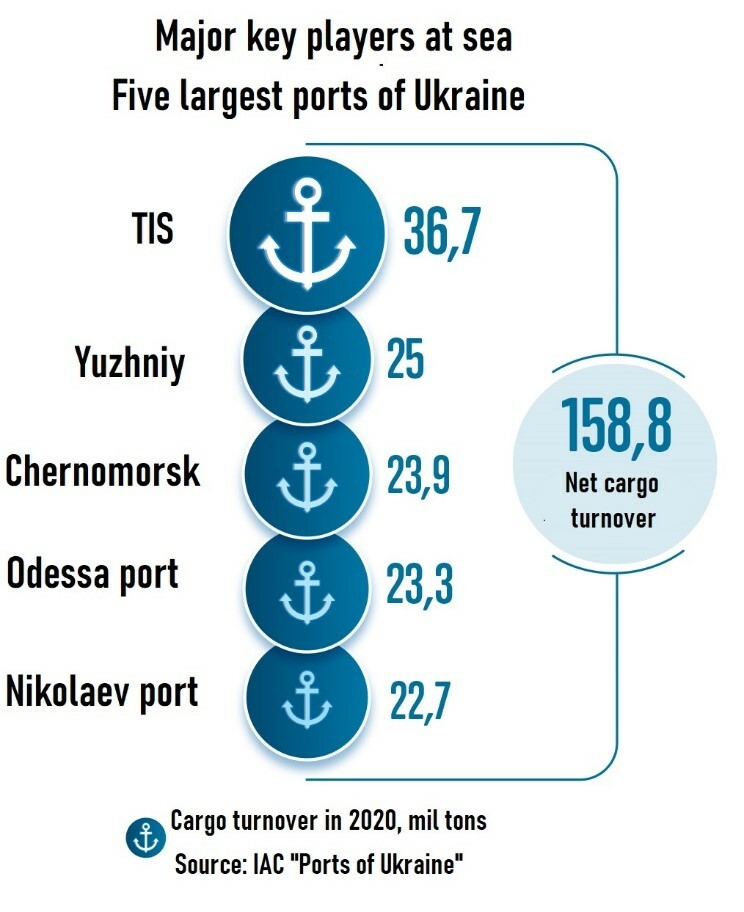

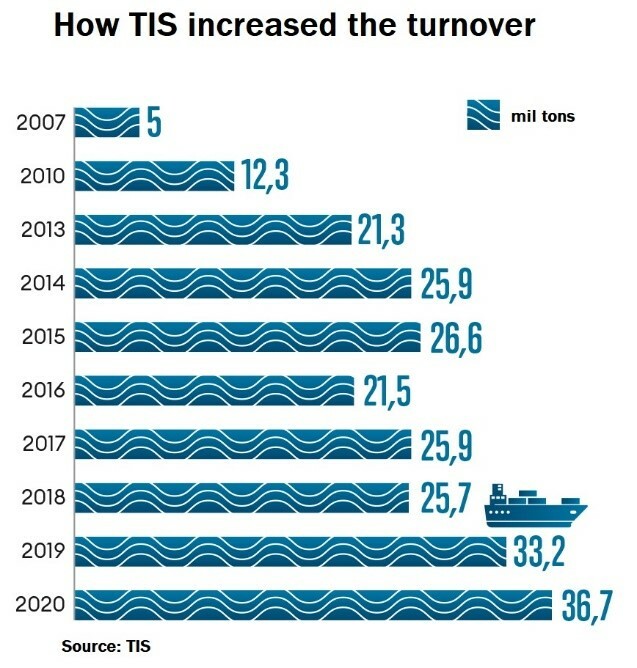

In 2020 the TIS terminals transferred 36,6 mil tons of goods. This is four times more than in 2008, when 25-year-old Stavnitser headed the company, and almost 10% higher than in 2019.According to specialized publication “Ports of Ukraine”, the chief competitor of TIS, sea port Yuzhniy, processed by one third less in 2020.

Large scale is one of the reasons why Stavnitser had decided to give up the position of General Director. “There’s no need to delude oneself: professional management and CEO are almost always more efficient than family business owners”, - he says. He believes that private owners of large companies could step into operational management only in two cases: during the development stage and at times of force major. Presently the group is undergoing the stage of quick growth, therefore it is time for a breath of fresh air from outside.

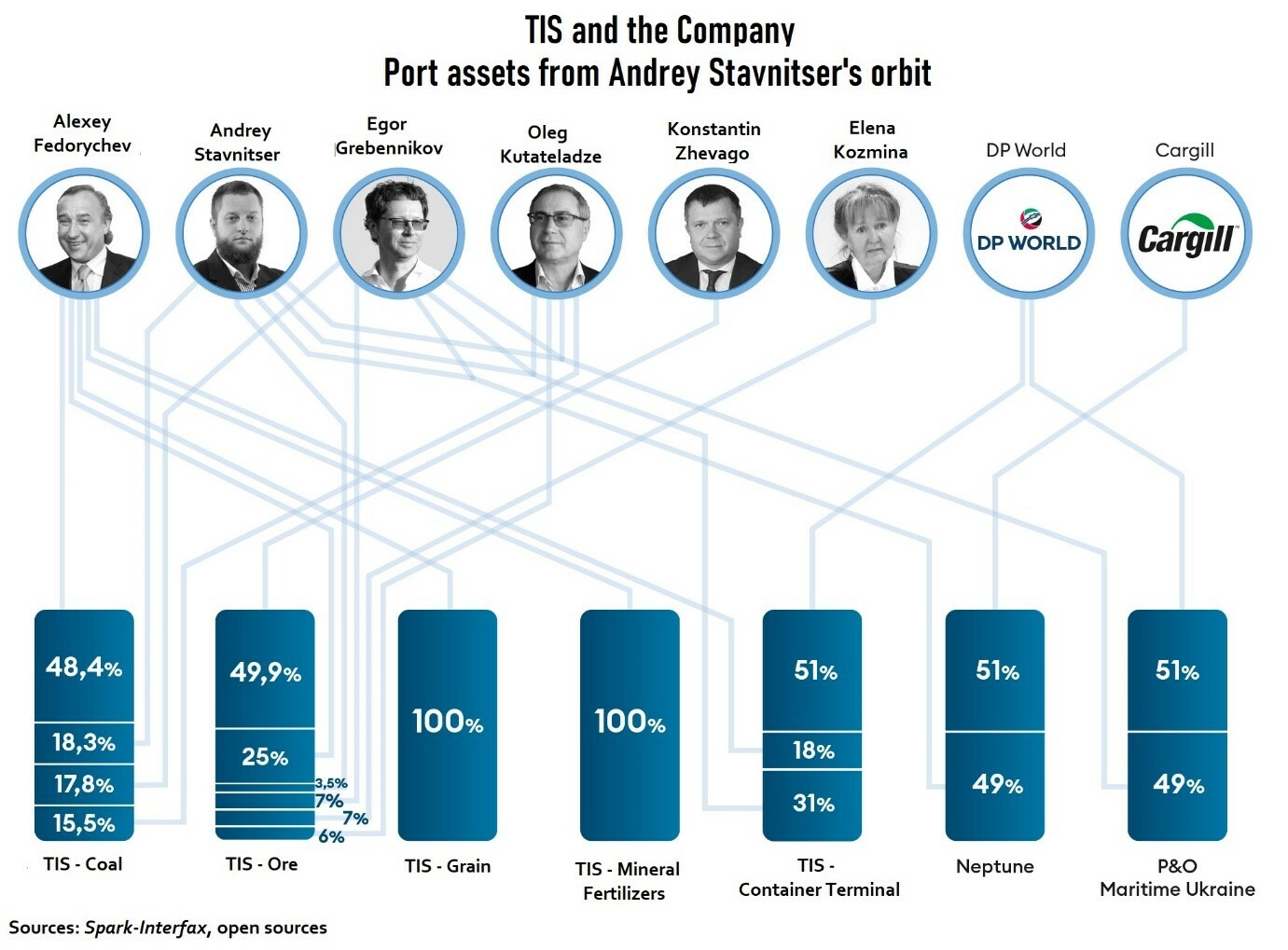

Another reason for transformation is related to the desire to increase the decision-making efficiency. The group has developed a complicated ownership structure, which affects its manageability. “TIS includes about 40 enterprises, and different shareholders own different amounts of shares”, - says Stavnitser.

Apart from him, the circle of major TIS shareholders includes his elder brother Egor Grebennikov, 48, one of the founders Oleg Kutateladze, 65 and the first investor of the group Alexey Fedorychev, 65. The latter joined elderborn Stavnitser and Kutateladze in 1997, when they had been seeking funds for re-equipment of an abandoned phosphates import terminal in Yuzhniy port.Sulphur and mineral fertilizers tradesman Fedorychev, who had emigrated from the USSR in the late 1980s, was just looking for a convenient place to process his goods. “I had significant chemical cargo traffic, he owned a chemical terminal. Why not meet up then?” – writes Fedorychev about how their partnership started in a book dedicated to Alexey Stavnitser. At their meeting a one-page agreement had been signed, and the new investor allocated $5 million for business development.

Stavnitser and Grebennikov (using his mother’s family name) acquired shares of the capital four years before the passing away of their father, who, having had found out his diagnosis, distributed the shares among his sons: a larger share to Egor and a smaller one went to Andrey.

Kutateladze nominated Andrey to the CEO office. Fedorychev says that this issue hadn’t been discussed with him, but he was ready to accept any decision by his companions. “I have always supported their stance, we’ve never been at odds with each other”, - he wrote, answering one of the questions by Forbes.

Why did they choose the junior, not the elder one? Kutateladze had sensed in him the energy and charisma one needs to become a leader. Besides that, Andrey had worked in the group for several years, whereas Egor had been outside the family business for a long time, developing projects of his own.Vitaliy Filatov, former director of the Ukrainian headquarters of grain traider Louis Dreyfus, who has known Alexey Stavnitser since the late 1990s says, that starting from the 2000s it was precisely Andrey who had been viewed as the managing heir.

“We decided it would be right for the successor to bear the name of Stavnitser”, - says Kutateladze. Egor is responsible for the finances, purchases and strategic technological development in the company. Kutateladze supervises legal issues and deals with development of the railway infrastructure. “Our foreign partner does not take part in the operational management”, - says Stavnitser, referring to Fedorychev who resides in Monaco. The partners have agreed that the business is run by the Ukrainian part of the shareholders – Kutateladze, Stavnitser and Grebennikov.Another partner, billionaire Konstantin Zhevago, owns 49,9% of the ore transshipping terminal. Zhevago uses the port to export pellets from the Poltava Mining and Processing Plant, which Is a part of his Ferrexpo.

Stavnitser considers Zhevago to be his most difficult partner, with whom he would never agree to do business again. “At our supervisory board meetings he screws your brains out of your ear and will not calm down until he gets what he wants. I believe it is of crucial importance for him for everyone around to lose, no matter whether he himself loses or wins,” - says Stavnitser who was born in Odessa. – “However, due to the fact that we own the control stake, we are nevertheless able to stand our ground”. Zhevago has not found time to answer the Forbes questions for this article.

Stavnitser is sure that his withdrawal and the new format of corporate management are going to benefit the company. “Let’s say you’ve got a voting coalition and a professional government administration,” - he draws an analogy, - “Which will you choose?”We are leaving coalitional history behind and transferring to professional management”.

Delegating authority to independent top-management would allow, in his opinion, to snap out of the “heir’s trap” where the TIS shareholders happened to find themselves. According to Stavnitser’s interpretation, such a trap occurs when the business owner starts to fail doing his very best, while still considering himself to be efficient, and thus slowing down the development process. “I believe our engagement in the business only makes things worse,” – he says, - “I think at the present stage the company does not require entrepreneurial competencies or personal involvement from neither of us”. After his withdrawal from the CEO position, all the shareholders will remain equally involved into the business, from now on as a supervisory board.

“The company has become larger and is now difficult to run by one or two people”, - agrees Grebennikov. – “It is companies with system management that are able to survive in the long-term 30-40-100 years period, – that involves special procedures, boards, supervisory boards and independent directors».

In the future, Stavnitser pictures himself in the sphere of mergers and acquisitions.This conversion occurred in his mind in 2011, after he had sold his family share of “TIS-Grain” terminal to Alexander Fedorychev. The cost of the deal remains confidential. According to evaluations of market members interviewed by Forbes, the brothers could make about $150 million off half of “TIS-Grain” terminal.

“We got a good deal of money all at once. This got us out of the circle of constructor-developers, and right into the category of investors,” – remembers Stavnitser. – “As soon as you’ve been able to sell something, you acquire quite a different role, you view yourself, your opportunities and potentials in a different light.”

In 2015, when negotiations with Cargill were entering final straight, Stavnitser realized that within TIS hs is bound by relationships with shareholders and limited by the transport industry, whereas he wished to have a wider perspective. This is how he grew to believe in the need of creating a company independent of TIS, that would manage the funds of the family and partners.

In order to organize the project he invited his childhood friend and M&A specialist Philipp Grushko, who had worked for the Munich office of PricewaterhouseCoopers for 10 years.One of the project in which he participated was the amalgamation of Porcsche and Volkswagen that was completed in 2012. Grushko recalls that he was not against “changing the wallpaper” and come back to Ukraine.“At a certain point I realized that what worked with Cargill we could do much more often, we could take it to the assembly line”, - says Grushko.

This is how SD Capital came into existence.“It was named after Henry Kissinger’s Shuttle diplomacy principle”, - says Deputy Director of Ukraine in the International Monetary Fund. Before he was appointed to his position in IMF, he had been helping Stavnitser and Grushko to structure the company for half a year. Its purpose is to guide international investors in Ukraine.The list of services includes developing market entry strategies, fund raising for greenfield projects (investment sites not supported by infrastructures), M&A aid, mutual transformation, managing purchased assets and searching buyers.

Rashkovan says that Stavnitser developed the model that his father had laid the foundation for by attracting resources belonging to Ukrainian industrial holdings. “Andrey attracts global players”, - says the financist. – “This is a very auspicious growth path”. It is also a good example of how descendants have been able not just to preserve but also to substantially develop their family business, adds Sergey Chuykin, Managing Director of investment banking department of Concorde Capital.

In SD Capital Stavnitser is responsible for the strategy, networking and attracting projects, whereas Grushko ensures the tactics palanning, processes and legal support.

This is how networking functions.In August 2015, at a Ukrainian-American investment forum in Washington, Andrey Pivovarskiy, Minister of Infrastructure,was approached by Van Yeutter, Vice President of Corporate Affairs, Cargill.His company had been negotiating with TIS about constructing a grain terminal in Yuzhniy, and wanted to garner institutional support of the Ukrainian government.Stavnitser, whom Pivovarskiy had not known yet, and Prime Minister Arseniy Yatsenyuk also joined the negotiations. According to Pivovarskiy, Yatsenyuk was greatly surprised by the readiness of Americans to invest dozens of millions dollars in a country-at-war. “On the way back aboard the plane we decided to provide every possible assistance for the investment to take place”, - remembers Pivovarskiy. – “And so it had”.

Besides the joint project with Cargill, the fund has in its portfolio two agreements with DP World, the world’s largest port operator. In 2017, SD Capital introduced to Ukraine its “daughter” – towing company P&O Maritime. And in summer of 2020 CD Capital completed the deal on selling to DP World 51% of the TIS container terminal.

The parties do not disclose the cost of the deal. In May 2020 Forbes interviewed industry analysts and estimated the value of the sold shares at $84–105 millions. Stavnitser claims that this estimation is well below the actual cost.

Out of a dozen projects developed by the fund, only one or two will normally launch successfully, says Stavnitser. The sale of the container terminal share lasted seven years from the moment of the initial contact until the signing of the contract, and the active stage took three years. In 2015, the ban by Turkey to let liquid bulk carriers through its straits lead to bust of a $65 million project on constructing an LNG-terminal near Odessa for transporting liquefied gas.Stavnitser is planning to revive this project as soon as the problem of allowing liquid bulk carriers to pass through the Bosphorus strait is solved.

SD Capital partners had big hopes for the land market to be opened, says Grushko.The company had been going to attract about $500 million, however the moratorium on foreign participation in land market transactions has suspended the project until at least 2024. “When the market opens, we shall get back to this issue, – at the time being it is impossible to invest more foreign moneyinto this sector,” – says Stavnitser.

Another unimplemented project is setting up SKD assembly of Canadian Bombardier locomotives. Grushko says that completion of the project turned out to be impossible because of a ban on private traction on Ukrainian railways. Without market liberalization and stable purchasing on behalf of Ukrzaliznytsya, production of locomotives will not “take off”.

One more idea is to put to practice in Ukraine the DP World experience on building industrial zones. TIS owns more than 500 ha of land near the port, and the Arab partners have created the largest free economic zone Jebel Ali on the border of Dubai and Abu-Dhabi. Why not combine efforts?

The operating name of the zone in Yuzhnyi – iPark. Stavnitser is hoping to complete negotiations with its two primary residents over the coming months. “One is from the food security branch, and I hope we will be able to attract a global marine carrier and a Ukrainian bird breeder as partners,” – says Stavnitser, - “I would appraise the CAPEX of this project as $20 million”.

What is going to happen to TIS? “Strange though it may seem, we see the future of this marine company afar from the sea”, - says Grushko. Its aim will be to deliver containers door to door to any reginal retailer right from the port by its own forces.“Transshipping cargo when it has arrived and whilst having all the capacities built for that, is no big deal”, - says Kutateladze. – “However, finding, consolidating and delivering cargos to clients is quite an interesting sphere to deal with.” Land logistics investments focus on setting up shunting stations and storage places, as well as on developing railway infrastructure, container trains and river transportation.”

Infrastructure business is the most “long-term” business in the world, says Stavnitser. Most recently he is interested in rapid formats. Having completed the DP World project, he began paying more attention to start ups, two of which he is investing into and two more he is acquainting himself with.

The most likely to be implemented shortly is his health-care project. It is called MetaMe.The main idea behind it is to enhance people’s quality of life: run off excess fat, boost the immune system and recouping one’s strength.Stavnitser does not disclose the investment value, noting that the project takes up seven-eight hours of his time per week. “Previously I only worked within the B2B market segment, whereas now I am dealing with B2C. There’s a great lot to learn”, - says Stavnitser.

The second project is marketplace. “One could call it an IT-project, but it is related to a real economy sector”, - explains the businessman. – “It is going to be represented by various goods, however fitting into one commodity group. ItisunparalleledwithintheCIScountries.”

Another sphere where he sees investment opportunities is hotel business. Stavnitser is planning to start with Odessa. “Only dead fish swims with the current”, - believes Stavnitser amid the panic related to the South African strain of COVID-19. – “Now is high time to enter this industry”. The businessman does not reveal the details, but announces his intention to execute a joint project in accord with a large hotel operator.

What comes next? “Since 2015 we have a great rule – to seal a deal per year,” – says Grushko. – “If we keep up the pace, things are going to run smoothly.”